With Customer Acquisition Cost at the forefront, get ready to dive into the world of business strategies and analytics like never before. From calculating costs to reducing expenses, this topic will uncover the secrets to maximizing your company’s growth potential.

Customer Acquisition Cost (CAC) is a vital metric for businesses looking to understand the cost of acquiring new customers. In this discussion, we will explore the definition of CAC, factors influencing it, strategies to reduce costs, and the importance of monitoring and analyzing CAC trends.

Definition of Customer Acquisition Cost

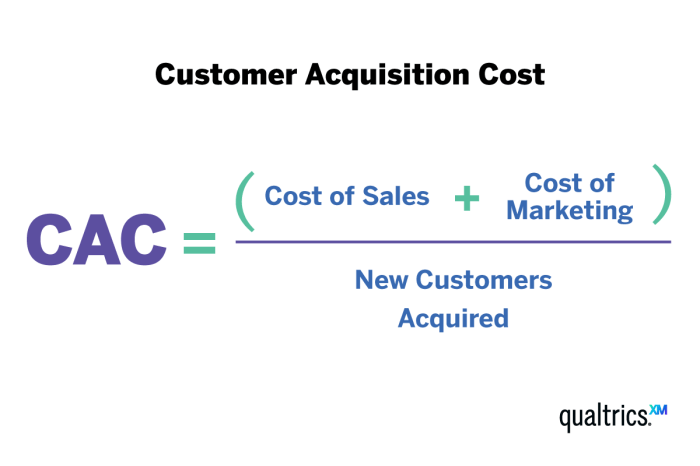

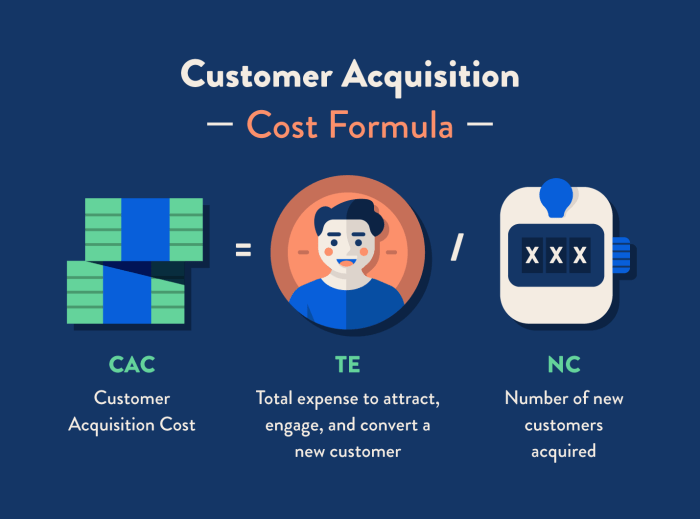

Customer Acquisition Cost (CAC) is a metric that calculates the total cost a company incurs to acquire a new customer. It is an essential factor for businesses to determine the effectiveness of their marketing and sales strategies in attracting and retaining customers.

Formula for Calculating CAC

CAC = Total Sales and Marketing Costs / Number of New Customers Acquired

- Identify the total costs associated with sales and marketing efforts.

- Determine the number of new customers acquired within a specific period.

- Divide the total sales and marketing costs by the number of new customers to calculate CAC.

Examples of CAC in Different Industries, Customer Acquisition Cost

In the e-commerce industry, companies often track CAC to evaluate the effectiveness of their online advertising campaigns. For subscription-based services like streaming platforms, CAC helps determine the return on investment for acquiring new subscribers. In the software industry, CAC is crucial for measuring the cost-effectiveness of acquiring new users for software products.

Factors Influencing Customer Acquisition Cost

Customer Acquisition Cost (CAC) is influenced by several key factors that businesses need to consider when calculating and optimizing their marketing strategies. Understanding these factors is crucial for effective customer acquisition and maximizing return on investment.

Marketing Channels Impact on CAC

Marketing channels play a significant role in determining CAC. Different channels have varying costs associated with acquiring customers. For example, paid advertising on social media platforms may have a higher CAC compared to organic search traffic. It is essential for businesses to analyze the performance of each channel and allocate resources accordingly to optimize CAC.

Customer Lifetime Value (CLV) and CAC Relationship

Customer Lifetime Value (CLV) is another critical factor that influences CAC. CLV represents the total revenue a customer is expected to generate throughout their relationship with a business. By increasing CLV, businesses can afford to spend more on customer acquisition, which can help lower CAC in the long run. Understanding the relationship between CLV and CAC is essential for building a sustainable and profitable customer acquisition strategy.

Strategies to Reduce Customer Acquisition Cost

To reduce Customer Acquisition Cost (CAC), companies can implement various strategies aimed at optimizing their marketing efforts and improving customer retention. By focusing on cost-effective methods, businesses can lower their overall CAC and improve their return on investment.

1. Organic versus Paid Acquisition

Organic acquisition involves attracting customers through non-paid channels such as content marketing, , and social media. This method is generally more cost-effective in the long run as it creates sustainable growth and builds brand loyalty. On the other hand, paid acquisition includes strategies like PPC advertising, influencer partnerships, and paid social media campaigns. While paid acquisition can yield faster results, it may lead to higher CAC in the short term.

2. Content Marketing and Optimization

Creating high-quality content that resonates with your target audience can help drive organic traffic to your website and generate leads at a lower cost. By optimizing your website for search engines and focusing on relevant s, you can improve your organic search rankings and attract qualified leads without spending a fortune on advertising.

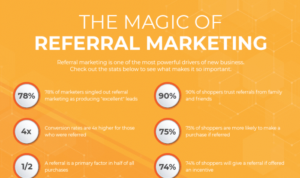

3. Referral Programs and Customer Loyalty

Implementing referral programs that incentivize existing customers to refer new ones can be a cost-effective way to acquire new customers. By rewarding loyal customers for their advocacy, businesses can tap into their existing customer base to drive word-of-mouth marketing and reduce CAC. Additionally, focusing on customer retention and building long-term relationships with your audience can lower overall acquisition costs by increasing customer lifetime value.

4. Data Analytics and A/B Testing

Utilizing data analytics to track the performance of your marketing campaigns and customer acquisition efforts can help identify areas for improvement and optimize your strategies. By conducting A/B testing on different marketing channels, messaging, and offers, businesses can refine their approach and allocate resources more efficiently, ultimately reducing CAC.

5. Social Media Engagement and Community Building

Engaging with your audience on social media platforms and building a strong online community around your brand can help attract new customers and retain existing ones. By fostering relationships with your followers and providing valuable content and support, businesses can leverage social media as a cost-effective acquisition channel and drive organic growth.

Importance of Monitoring and Analyzing Customer Acquisition Cost

In the world of business, keeping a close eye on your Customer Acquisition Cost (CAC) is absolutely crucial. Understanding and analyzing your CAC can make or break your business’s success. Let’s dive into why monitoring and analyzing CAC is so important.

Why Tracking CAC is Crucial

Tracking your CAC allows you to measure the effectiveness of your marketing and sales strategies. By knowing how much it costs to acquire a new customer, you can make informed decisions about where to allocate your resources. This data is essential for determining the overall health and sustainability of your business.

- Helps in budget allocation: Monitoring CAC helps you allocate your marketing budget more efficiently by focusing on channels that bring the highest return on investment.

- Identifies inefficiencies: Analyzing CAC can reveal inefficiencies in your sales funnel, allowing you to optimize your processes and reduce costs.

- Guides pricing strategies: Understanding CAC can also help you set pricing that ensures profitability and sustainable growth.

Significance of Analyzing Trends in CAC Over Time

Analyzing trends in CAC over time provides valuable insights into the growth and performance of your business. By tracking changes in CAC, you can identify patterns and adjust your strategies accordingly to improve efficiency and profitability.

Monitoring trends in CAC can help you anticipate changes in customer behavior, market conditions, and competitive landscape, allowing you to stay ahead of the curve.

Tools and Techniques for Monitoring CAC

There are various tools and techniques available to effectively monitor and analyze CAC. Utilizing these resources can help you streamline your processes and make data-driven decisions to enhance your customer acquisition efforts.

- Customer Relationship Management (CRM) software: CRM systems like Salesforce, HubSpot, or Zoho can help you track customer interactions, conversions, and acquisition costs.

- Google Analytics: Analyzing website traffic and conversion data through Google Analytics can provide valuable insights into the effectiveness of your marketing campaigns.

- A/B testing: Conducting A/B tests on different marketing strategies can help you identify the most cost-effective approaches for acquiring customers.