With First-Time Home Buying Tips at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling journey filled with unexpected twists and insights.

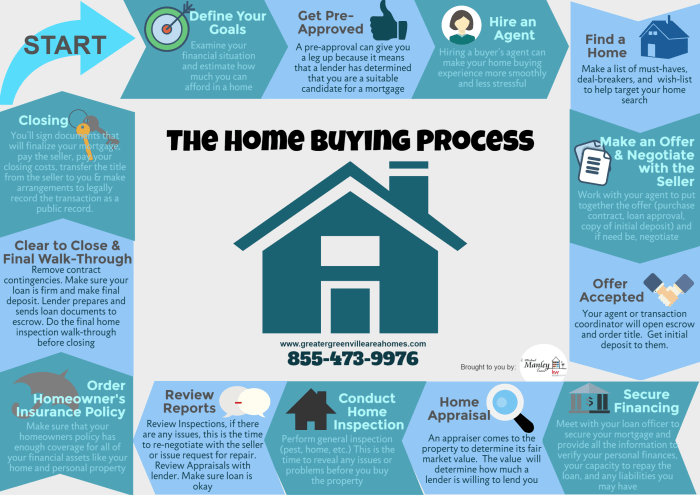

Looking to buy your first home? This guide will walk you through essential tips on researching the market, financial preparedness, working with real estate professionals, and property selection and inspection.

Researching the Market

Researching the real estate market is crucial for first-time homebuyers to make informed decisions. By understanding current trends and prices, buyers can ensure they are getting a good deal on their new home.

Finding the Right Neighborhood

When looking for the perfect neighborhood, consider factors like safety, amenities, and future development plans. Research crime rates, proximity to schools and parks, and any upcoming projects that could impact property values.

Exploring Different Property Types

It’s important to explore different types of properties to assess affordability and suitability. Condos may offer lower maintenance costs, while single-family homes provide more privacy. Townhouses can be a good middle ground for first-time buyers.

Financial Preparedness: First-Time Home Buying Tips

Before diving into the home buying process, it’s crucial to assess your financial readiness. This involves evaluating your credit score, saving for a down payment, budgeting for additional costs, and understanding mortgage options.

Assessing Your Credit Score

One of the first steps in determining your financial readiness is checking your credit score. A good credit score is essential for securing a favorable mortgage rate. You can obtain a free credit report from each of the three major credit bureaus – Equifax, Experian, and TransUnion – once a year. Make sure to review your report for any errors and take steps to improve your score if needed.

Saving for a Down Payment

Saving for a down payment is another important aspect of financial preparedness. Most lenders require a down payment of at least 3% to 20% of the home’s purchase price. Start saving early and consider opening a separate savings account specifically for your down payment fund. You may also explore down payment assistance programs that can help first-time buyers.

Budgeting for Additional Costs

Aside from the down payment, homebuyers should budget for additional costs such as closing fees, property taxes, and ongoing maintenance expenses. These costs can add up quickly, so it’s important to factor them into your overall budget. Consider creating a detailed budget that includes all potential expenses to ensure you’re financially prepared for homeownership.

Getting Pre-Approved for a Mortgage

Before starting your home search, it’s recommended to get pre-approved for a mortgage. This involves submitting financial documents to a lender who will determine the loan amount you qualify for based on your income, credit score, and other factors. Being pre-approved not only helps you understand your budget but also makes you a more competitive buyer in a competitive market.

Understanding Loan Options, First-Time Home Buying Tips

As a first-time buyer, it’s essential to understand the various loan options available. From conventional loans to FHA loans, VA loans, and USDA loans, each option has its own requirements and benefits. Research different loan programs, compare interest rates, and consider seeking advice from a mortgage broker to find the best option for your financial situation.

Working with Real Estate Professionals

When it comes to buying your first home, working with real estate professionals can make the process much smoother and less stressful. Real estate agents, real estate lawyers, and mortgage brokers play crucial roles in helping first-time buyers navigate the complexities of the housing market and secure the best possible deal.

Role of Real Estate Agents

Real estate agents are licensed professionals who help buyers find the right property based on their needs and budget. They have access to a wide range of listings and can provide valuable insights into local market trends. When choosing an agent, look for someone who is experienced, knowledgeable, and has a good track record of helping first-time buyers successfully purchase their dream homes.

Benefits of Working with a Real Estate Lawyer

A real estate lawyer can review purchase agreements, contracts, and other legal documents to ensure that everything is in order and protect your interests throughout the transaction. They can also help resolve any legal issues that may arise during the buying process, giving you peace of mind and avoiding potential pitfalls.

Collaborating with a Mortgage Broker

Mortgage brokers work with multiple lenders to help buyers find the best loan rates and terms based on their financial situation. They can guide first-time buyers through the mortgage application process, assist in comparing loan options, and negotiate on their behalf to secure the most favorable terms possible. Collaborating with a mortgage broker can save you time, money, and stress when securing financing for your new home.

Property Selection and Inspection

When it comes to choosing the right property for your first home purchase, there are several key factors to consider. From viewing potential properties to conducting a thorough inspection, making an informed decision is crucial. Here’s a breakdown of the steps involved in property selection and inspection:

Viewing Potential Properties

- Attend open houses and showings to get a feel for the layout and condition of the property.

- Look for signs of wear and tear, such as water damage, cracks in the walls, or outdated fixtures.

- Prioritize your must-haves and deal-breakers to narrow down your options effectively.

Home Inspection Process

- Hire a professional home inspector to thoroughly assess the property for any hidden issues or damages.

- Pay attention to the structural integrity, plumbing, electrical system, and overall safety of the home.

- Review the inspection report carefully and consider the implications of any major repairs or maintenance needed.

Future Resale Value and Renovation Costs

- Think about the long-term value of the property by researching the neighborhood trends and market conditions.

- Consider the potential costs of renovations or upgrades to make the property more appealing in the future.

- Consult with real estate professionals to assess the resale value and investment potential of the property.